Embracing the Journey of Revenue Growth Beyond $1 Million

Originally published on www.sorensoncapital.com

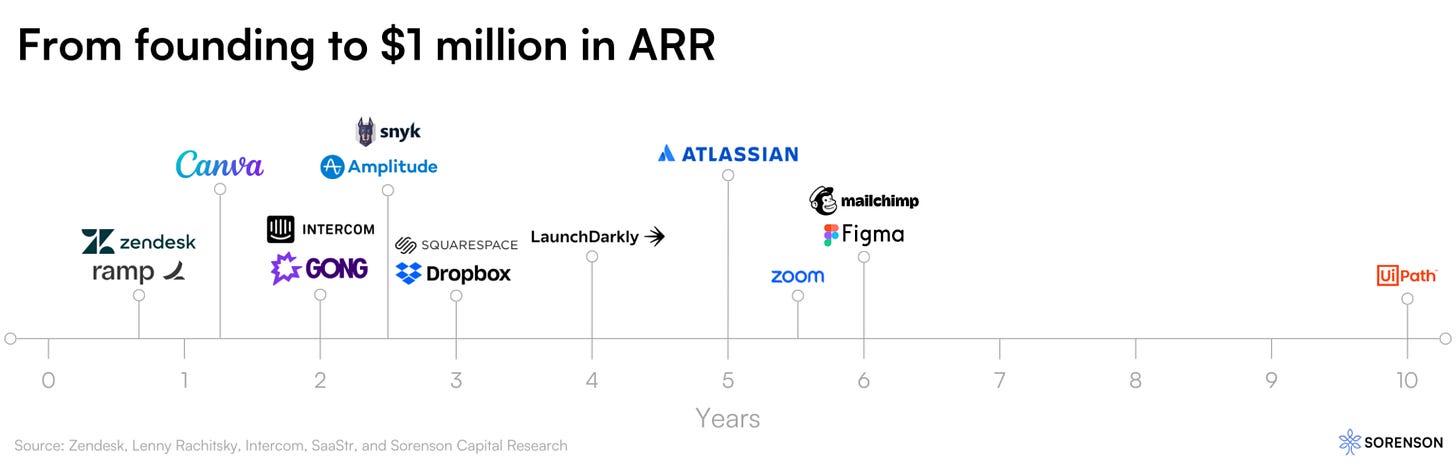

Achieving the coveted $1 million mark in annual recurring revenue (ARR) is an exciting milestone for any startup. It’s a sign that your product has achieved some early evidence of product-market fit and that you might be on the path to building a scalable, profitable business. While there is pressure to hit this milestone as quickly as possible, there is no shortage of iconic software companies that we admire that might have taken four years or longer to surpass the $1 million milestone.

For VCs, it’s tempting to focus heavily on revenue as a key metric when evaluating companies. In the midst of the uncertainty and ambiguity that comes with assessing early-stage startups, revenue can appear to be a clear, quantifiable measure of success. However, after being an investor for 10 years, I’ve learned over time where to be flexible in my thinking and not overly anchor myself to the excitement of early revenue or the lack thereof.

Revenue metrics and growth always matter. Yet, the growth-at-all-costs mentality isn’t the only path to success, as proven by companies like Atlassian and Procore, which took four to five years to surpass $1 million in ARR. There are plenty of examples of startups where a “slow” start led to breakout success and category leadership.

“Revenue can be distracting and can lead to short-sighted decisions. In the world of SaaS, many choose to follow established playbooks that they believe are foolproof but might not align with their goals. Instead, we employ toolkits that enable us to challenge assumptions and frequently take a different path.” – Ryan Sanders, Co-Founder & Co-Chair of BambooHR, a Sorenson portfolio company

So let’s get specific. I’ve observed four key dynamics that often mean a startup might be slower in revenue generation out of the gate but still has compelling potential for hyper-growth, than the “storybook” startups that gobble up headlines. Alone or in combination, these dynamics determine when it is reasonable to expect growth to begin in earnest.

The Four Dynamics That Impact Time to $1M ARR

1. Product Development

At Sorenson, we often emphasize the importance of developing products that solve mission-critical problems for customers and have “lots of guts”. Developing high-quality products necessitates a comprehensive and often prolonged development phase. This valuable process, while essential for building a robust and innovative product, can indeed delay a startup’s journey to $1 million in revenue. However, this delay should not be seen as a setback but rather as a strategic investment. By focusing on creating a product with deep technological foundations, startups are more likely to achieve lasting impact and success in the market.

One of the core values at Couchbase, a Sorenson portfolio company that exited, is “Attack Hard Problems.” Tackling complex challenges and creating a robust, all-encompassing product is a time-consuming process. This involves collecting insights from design partners and early customers, then using that feedback to add features and iterate the product over several cycles.

Known today as a leader in electronic signature technology, DocuSign faced a classic “chicken or the egg” problem early on. The company struggled initially to identify the most receptive market vertical. While they eventually found a stronghold in real estate, a sector greatly benefited by the digitization of signing processes, getting there wasn’t straight-forward. The real estate industry is typically slow to adopt new technologies, which meant DocuSign had to invest considerable time in educating potential users and iterating the product to meet specific industry needs. This phase in DocuSign’s story was critical to developing a product that could achieve wide adoption and become indispensable to its users.

Another example is Bridgecrew, a codified cloud security startup and an exited Sorenson portfolio company. Bridgecrew relied heavily on its open-source model to build a user base and gather valuable feedback, which was indispensable for product development. However, transitioning from an open-source model to a scalable revenue-generating business model takes significant time and effort. The need to add substantive value beyond the basic free tools required continuous innovation and development, which resulted in the company taking time to ramp up ARR, but ultimately was the right investment to make. Bridgecrew was widely recognized as the leader in the emerging space of “shift left” cloud security, bridging the gap between developer and Chief Information Security Officer (CISO), and acquired by Palo Alto Networks in March 2021.

“Patience in scaling doesn’t just build a product; it builds a legacy. If you’re confident in the utility and necessity of what you’re creating, then taking the time to do it right isn’t just good practice—it’s essential.” – Idan Tendler, CEO and Co-Founder of Bridgecrew, a Sorenson portfolio company that exited

2. Land-and-Expand

Land-and-expand is a common growth strategy used by software startups to initially gain a foothold in a new customer’s organization (“land”) and then gradually increase their presence within that organization over time (“expand”). This strategy can take several forms. Often, it involves starting with a smaller, often low-friction-to-adopt solution that scratches an itch, and then leveraging this initial success and trust to upsell and cross-sell additional products. Sometimes, it takes the form of landing a small number of initial users and then spreading across other teams and users in the organization.

Slack is frequently cited as the poster child for land-and-expand success – one team finds value in the product, which incentivizes them to convince other teams inside the organization to adopt it, and the momentum snowballs from there.

Another example is PlanGrid, the digital blueprint company acquired by Autodesk for $875m million. Initially adopted by individuals on construction sites, workers equipped with iPads could effortlessly display and share blueprints on-site using PlanGrid, contrasting sharply with their colleagues who had to manage cumbersome paper blueprints. This striking difference not only highlighted the efficiency of PlanGrid but also sparked interest among other teams who observed these interactions. As a result, the demand for PlanGrid spread organically across the site, facilitating wide adoption without the need for aggressive sales tactics.

Land-and-expand is the type of organic growth that B2B marketers drool over, but it takes time for even the most compelling software offering to win the hearts of users one by one and spread across a customer organization.

3. Market Education

If you are building a product in a nascent space “where the puck is going”, the market often needs time to understand the problem and decide how it wants to solve it.

Take LLM (Large Language Model) security as an example. While there is no doubt that enterprise use of generative AI will introduce new attack vectors, the specific applications of generative AI within enterprises are still developing and evolving. It is challenging to establish defenses when these new frontiers are not yet clearly defined. As a result, many CISOs are cautious about investing in LLM security tools immediately. If you are developing an LLM security startup, even with the best product on the market, adoption may take time as the market continues to learn about the emerging challenges, and benefits of your product.

Sometimes, the problem may already exist but represent a new category. For instance, Talon Security’s browser-based security solution was a new category that the company pioneered. Founded in 2021 during the peak of the COVID-19 pandemic, the shift towards a fully digital workforce created a fertile ground for security breaches. Bad actors exploited vulnerabilities arising from employees working remotely on devices beyond company oversight. The Internet browser emerged as a vulnerable gateway to business-critical assets. Talon focused on educating CISOs about the newfound criticality of browser security in a modern work environment. This educational process took time, but as demonstrated by Palo Alto Networks’ recent acquisition of Talon for $625 million, taking the time to create and educate a market about a new category can indeed be highly rewarding.

“The key isn’t just hitting the $1 million mark, but who our customers are and the quality of our deals at that milestone. It’s not about how fast we get there, but securing the right partners that will lead to an outstanding product and create a market snowball effect. Anyone can ‘buy’ a few deals, but true success comes from strategic growth and genuine partnerships.” – Ofer Ben-Noon, Co-Founder and CEO of Talon Security, a Sorenson portfolio company that exited (acquired by Palo Alto Networks)

4. Sales Cycle and Industry Dynamics

Selling into large enterprises typically involves long-ish sales cycles, especially when the offerings are complex or high-value. These cycles vary by industry but often involve considerable time spent identifying leads, navigating through organizational decision-making, and finalizing deals. Particularly in highly regulated sectors like healthcare and financial services, additional hurdles, such as compliance and security reviews, are common. These challenges can result in low initial revenue velocity, but may nonetheless be fruitful investments in the long term.

At Sorenson, I interface with a lot of startups that are facilitating the production of goods and services (dubbed “Future of Industry”) and those that are enhancing the movement of these goods and services (dubbed “Future of Commerce”). The companies in these markets often serve a large number of human users of varying levels of sophistication, and may even involve hardware as the enabling layer, which can add to the implementation burden. For these reasons, it is not atypical for startups in these industries to have slow initial revenue ramp.

Take Afresh, for example, which offers inventory management and fresh food ordering software for grocery retailers. Grocery retailers have traditionally been technology-averse. Afresh starts its customer engagement by analyzing historical data from retailers to simulate and benchmark actual performance with a performance they would have had if they had used Afresh. This analysis helps demonstrate possible ROI through reduced waste and increased profits. If the customer makes a go decision, they start with a small-scale deployment, typically one to five stores, then move to a larger deployment. This all takes time. The first set of Afresh’s paying customers were small regional retailers who took a leap of faith, but over time they have expanded to serve the likes of Albertsons and have been able to build a scale business in an end-market that is typically seen as challenging.

Companies like Sight Machine, a Sorenson portfolio company, that operate in the manufacturing sector face similar challenges. Manufacturers are risk-averse when it comes to new software purchases. Sight Machine, as a Manufacturing Data Platform, aids factories in optimizing production and improving efficiency through data analysis. The initial engagement usually begins with a Proof of Concept (POC). While the key buyer tends to be operations management (e.g. General Manager, Head of Factory), CFO and IT are also important stakeholders in the sale. While getting started with customers in this type of end market may take time, successful implementations often lead to multi-year, multi-facility high-value contracts in the six to seven figures.

The journey to $1 million in revenue may be slow for startups in these sectors, but as demonstrated by Sight Machine’s and Afresh’s success, the long game can still lead to a scalable and profitable business.

Advice to Early-Stage Founders

For early-stage founders who find themselves operating in a “delayed growth” environment, the journey can often feel daunting. Here is some advice for how to lay a strong foundation for long-term success.

1. Understand why it will take longer to get revenue traction.

The first step is to understand precisely why it should take longer and make it a deliberate decision. It may be due to some combination of the four dynamics above. If the path to $1 million in ARR is unclear because the market doesn’t genuinely value the current iteration of your product, you might need to pivot. This period of introspection can be invaluable in figuring out a plan for the long game.

2. Find the right set of investors.

It’s crucial to partner with investors who grasp your venture’s nuances and are willing to support you through the extended phase of scaling to $1 million ARR. Investigate successful companies that serve as benchmarks for your own venture and initiate discussions with their investors. They’re more likely to respect the revenue dynamics, risk profile, and overall potential of your business. These seasoned backers can offer not only capital but also invaluable guidance and understanding of the unique opportunities you face, as well as empathy.

3. Optimize for the long-run, not short-run.

It is totally okay to have conviction that in the earliest stages of your venture the right thing to do is prioritizing something other than revenue. Resist generating revenue for the sake of it.

In pursuit of initial revenue, there’s a temptation to onboard any customer who shows interest. However, aligning with the wrong customers can be detrimental in the long run. Focus on those whose needs closely match the solution you offer, even if it means slower revenue growth initially. This approach ensures that your product development is in line with genuine market needs and sets a solid foundation for scaling.

“The path to $1M ARR is where you build your customer centricity as an organization. The way you serve and engage your customers during this phase will set the expectations for your team, and the broader market.” – Zak Hemraj, Co-Founder and CEO of Loopio

Remember, some of the most successful companies today faced early challenges and slow starts. What often sets successful founders apart is their ability to stay the course, adapt their strategies, and maintain a clear focus on their ultimate goals. Stay positive, stay focused, and keep building towards the future you envision. Your patience and persistence will be your greatest assets as you work towards turning your vision into a thriving business. And if you ever need advice or want to brainstorm together, please reach out.