Is going public through a SPAC merger truly cheaper than IPOs or direct listings?

SPAC is all the rage. Is it truly the best way to go public?

Originally published on my personal blog on Oct 15, 2020

TLDR

SPACs are highly idiosyncratic

It is an incredibly expensive way to go public (AND I'LL SHOW YOU THE MATH on the Social Capital - Opendoor transaction)

Introduction

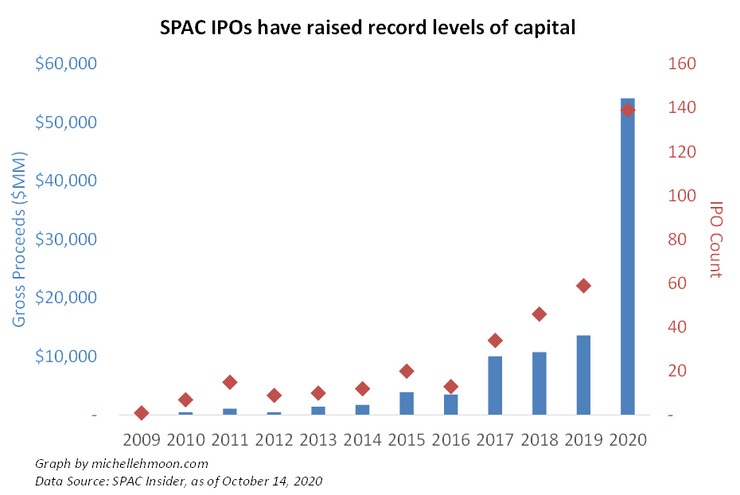

Special Purpose Acquisition Companies (SPACs) are flooding the headlines in recent months, as a record high number of these “blank check” companies have raised capital and publicly listed their shares. For companies wanting to go public, SPACs have emerged as a popular alternative to traditional IPOs and direct listings.

[Exhibit] SPACs are the talk of the town

Why are these companies going public via SPAC mergers, versus IPOs?

There is a plenty of great literature on the mechanics of SPACs. If you want to get up to speed on this topic, here is a couple of great sources to check out:

https://techcrunch.com/2020/08/21/almost-everything-you-need-to-know-about-spacs/

http://abovethecrowd.com/2020/08/23/going-public-circa-2020-door-3-the-spac/

Perhaps Bill Gurley of Benchmark Capital is the most vocal critic of IPOs in Silicon Valley.

“The traditional way of going public is systematically broken and is robbing Silicon Valley founders, employees, and investors of billions of dollars each year.” – Bill Gurley, Benchmark Capital

The public misleadingly perceives the “pop” on the first day of trading after an IPO as a positive. On the contrary, this represents an underpricing, which comes at a cost to the company and existing shareholders. Rewards, which should have rightfully gone to founders, employees and existing investors who built the company and stuck through all the ups and downs for years, are being transferred to investors who just bought the stock through the IPO a day ago. No homeowner should sell his or her house 31% below market. Companies shouldn't either.

[Exhibit] IPO “pops” come at a cost to the company and existing investors

According to the research of Jay Ritter at the University of Florida, an average company that went public in the first half of 2020 was underpriced by 31%. Given that offering expenses range around 5% to 7% of the IPO size, the cost of capital from IPOs equates to over 36% (5% + 31%).

Bill Gurley argues that the traditional IPO process, which involves one-on-one meetings between the management team and select institutional investors and a manual allocation process by the underwriters’ ECM desks, robs value that should have gone to the company's founders, employees and existing investors. For this reason, Bill Gurley asserts that companies should consider direct listings and SPAC mergers as an alternative to traditional IPOs as a more efficient route to achieve liquidity.

How does a company go public via a SPAC?

The target company, which merges with a SPAC to go public, essentially negotiates a merger transaction with the SPAC’s management team. This could mean a greater certainty on proceeds and timing than a traditional IPO where the pricing happens hours before a company lists on the exchange, and the offering can be pulled or postponed anytime if market conditions were to deteriorate.

While many of Bill Gurley’s criticisms are well-founded, I would hesitate writing off traditional IPOs entirely as being “broken”. This sentiment is concurred by Josh Kopelman at First Round Capital.

“I'm not sure I'd argue that … (IPOs are) broken. I actually think that you are seeing far more companies exit, and we have seen a real acceleration in both the number of exits and the size of those exits, which I think is a promising thing. I think there is a benefit to the transparency the public market shines on a company, because that's how you could truly lock in a value. We've all seen companies that have garnered valuation x in the private markets only to find out it's not a true representation of the company's ultimate value when it was fully transparent in the public markets. So I think the IPO process is a healthy process in general and over the last two years we have seen an incredible acceleration.” – Josh Kopelman, First Round Capital

In response to the market’s increasing interest in alternatives to traditional IPOs, the SEC recently approved a new type of direct listings on the NYSE. It will allow companies to issue new stock (known as a “primary offering”). Historically the NYSE had allowed existing investors to sell shares in a direct listing (known as a “secondary offering”), but companies could not raise new capital.

Is going public via a SPAC truly cheaper than an IPO?

The short answer is that “it depends”. In any case, going public via a SPAC can be deceptively costly. Let me demonstrate this point using the Social Capital Hedosophia II – Opendoor transaction as a case study.

Social Capital Hedosophia II (“IPOB”), one of numerous blank-check companies associated with investor Chamath Palihapitiya, announced that it will merge with Opendoor, taking the private real estate startup public in the process.

[Exhibit] Social Capital Hedosophia II Trading History

IPOB’s IPO was completed on April 30, 2020 at $10/unit. Each unit was comprised of one common share plus one-third of a warrant exercisable at $11.50/sh.

The merger between IPOB and Opendoor was announced on Spetember 14. The news was favorably received, with IPOB’s share price popping and closing at $17.58/sh on September 15, approximately 62% higher than IPOB’s average closing price of $10.88/sh during the month of August. The stock has traded up since, and closed at $26.48/sh today (as of October 14, 2020).

The economics of the deal were fixed prior to announcement, pinning the value of Opendoor at $5.0B, which equated to approximately 500MM IPOB shares being issued to Opendoor investors. The share price appreciation since merger announcement benefits Opendoor shareholders who will be allowed to sell their shares in 6 months (probably sooner).

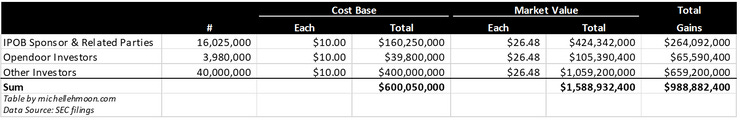

[Exhibit] Promote to Social Capital and related parties

Social Capital and its related parties (“the sponsor”) owned 20% of the pre-merger IPOB, having paid $0.0024 per share. This contrasts with $10 per unit (including a fractional warrant) that public shareholders paid in the IPO. I see the lack of paid-in capital by the sponsor as a potential source of misalignment between the sponsor and third-party investors. In the end, Social Capital’s ownership percentage was diluted down by 500MM IPOB shares being issued to Opendoor investors. Nonetheless, the sponsor was able to capture a whopping $621MM in gains.

Sponsor promote is not the only source of "leakage". Prior to public announcement of the merger with Opendoor, Social Capital approached select institutional investors who under NDA became privy to the details of the transaction and were offered an exclusive opportunity to buy IPOB shares at $10/sh. This is generally referred to as a PIPE transaction (private investment in public equity). These PIPE investors were able to buy IPOB shares with the knowledge of the Opendoor transaction significantly below the merger announcement-affected share price ($17.58/sh on September 15).

[Exhibit] Underpriced PIPE

[Exhibit] Total Leakage

Aggregating these figures, the total “leakage” that comes at a cost to Opendoor shareholders from transaction fees, management promote and PIPE underpricing was $1.3B, or 9% of IPOB-Opendoor’s pro-forma enterprise value.

While this 9% leakage from the mechanics of going public via a SPAC is smaller than the typical IPO underpricing quoted in Jay Ritter’s research, the dollar figure ($1.3B) makes me scratch my head.

Other Concerns

Usually the management team of a SPAC has two years to find and transact with a target company. Given the latest explosion in SPAC IPOs, there is a lot of capital chasing acquisition targets. Anecdotally, A LOT of growth stage companies that I spoke with over the last couple of months mentioned being in merger discussions with SPACs. In some cases, this made sense. In many cases, I was deeply skeptical about their investment worthiness and preparedness as a publicly traded entity.

There is a tangible risk that some SPACs might not be able to consummate an acquisition and would be dissolved after two years. Worse yet, it might create perverse incentives for the management teams of SPACs to pay an unjustifiably high price to consummate a transaction, or accelerate the acquisition process without proper due diligence.

This concern is perhaps embodied in the following example. Nikola Corporation is under investigation by the Department of Justice and SEC after a well-known short seller Hindenberg publicized potential fraud allegations (link). Based on its SEC filings, VectoIQ Acquisition Corp., the SPAC that merged with Nikola Corporation, went from a first meeting (November 25, 2019) to the signing of transaction documents (March 2, 2020) in three months, an exceptionally short timeframe of due diligence for a transaction of this size. The merger proposal was publicly announced on March 3, 2020. Back in my days in investment banking, a deal of this scale usually involved four to six months of intense due diligence and negotiations. VectoIQ Acquisition Corp. went public in May 2018, and was due to be dissolved in May 2020. Could VectoIQ have cut corners in fulfilling its fiduciary duty under time pressure?

[Photo] Troubled former Nikola executive chairman Trevor Milton stands next to a truck at Nikola World 2019

(Photo Source: CNN)

A few years back, SPACs had the reputation of being run by sub-par quality management teams. It also remains to be seen whether some of the individuals who have been successful in raising SPACs are sufficiently qualified and experienced to deliver a satisfactory outcome to shareholders. I believe that this is one of the reasons why the market has recently seen a few SPAC IPOs, which were downsized or are subsequently trading below IPO prices in the markets.

Concluding Thoughts

I am always excited to see more options being made available to companies that want to go public. While the SPAC vehicle is not a new invention in any way, I see the rising popularity of SPACs as a generally positive development in capital markets. However, SPACs are far from being a perfect solution. In fact, they usually come with a complex list of governance challenges and deal leakage.

[Photo] Bill Ackman is hunting for a "mature unicorn" after launching his SPAC, Pershing Square Tontine Holdings

(Photo Source: Bloomberg)

These concerns are not lost on the SPAC community. Pershing Square Capital Management founder Bill Ackman is trying to build the "most investor friendly SPAC in the world" through the newly launched Pershing Square Tontine Holdings. No, he is not buying a bunch of founder shares pre-IPO at $0.0024 each. Pershing Square Funds are in fact purchasing at minimum an aggregate of $1B of units at $20/unit, the same price that the public paid in the IPO. The performance of Pershing Square Tontine Holdings remains to be seen. Nonetheless, I view these experiments and innovations as being essential to the continued proliferation of the SPAC market.

As an investor, I would be encouraging the companies that I am involved with and are thinking about going public to consider all the options (e.g. IPO, direct listing, SPAC merger) on the table before deciding on an optimal path forward.

Views expressed in this post are of my own. These do not represent views of any organization or employer I am currently or was previously associated with. The math presented in this post is for illustrative purposes only and subject to reasonable but simplifying assumptions.